The Ultimate Guide to Forex Trading: Strategies, Tips, and Insights

Forex trading, or foreign exchange trading, is a global decentralized or over-the-counter (OTC) market for trading currencies. Through this market, individuals and institutions can buy, sell, exchange, and speculate on the value of different currencies. With a daily trading volume exceeding $6 trillion, Forex is one of the largest financial markets in the world. For anyone looking to dive into this world, it is crucial to understand the market dynamics, trading strategies, and risk management techniques. This guide provides a comprehensive overview of Forex trading, including opportunities and challenges, as well as insights that can help both beginners and experienced traders enhance their skills. Moreover, consider choosing a reliable trading broker such as trading forex Trading Broker ID to ensure a smooth trading experience.

Understanding Forex Market Basics

The Forex market operates 24 hours a day, five days a week, and is divided into three major trading sessions: the Asian, European, and North American sessions. Each session has its own characteristics and influences the trading landscape at different times. Traders can take advantage of these sessions to maximize their trading potential.

Currency Pairs

Forex trading involves trading currency pairs, which include a base currency and a quote currency. The value of a currency pair is determined by the exchange rate, which reflects how much of the quote currency is required to purchase one unit of the base currency. Popular currency pairs include EUR/USD, USD/JPY, and GBP/USD. Understanding how to read and analyze these pairs is fundamental for any successful Forex trader.

Market Participants

The Forex market consists of various participants, including central banks, financial institutions, corporations, and individual traders. Each participant plays a significant role in shaping the market dynamics. Central banks implement monetary policies that directly influence currency values, while individual traders and institutions engage in speculative trading to capitalize on price fluctuations.

Trading Strategies in Forex

Several trading strategies can be employed in Forex trading, each with its own set of advantages and disadvantages. Here are a few popular ones:

1. Day Trading

Day trading involves buying and selling currencies within the same trading day. Traders who pursue this strategy seek to capitalize on short-term price movements and often use technical analysis and charts to identify trading opportunities. This strategy requires constant market monitoring and can be risky due to sudden price fluctuations.

2. Swing Trading

Swing trading is a strategy that aims to capture short- to medium-term price movements. Swing traders typically hold positions for several days or weeks, allowing them to take advantage of price swings. This approach requires less active monitoring compared to day trading, making it suitable for traders with other commitments.

3. Scalping

Scalping is a high-frequency trading strategy where traders make numerous trades throughout the day, aiming for small profits on each trade. This strategy requires a good understanding of market mechanics and quick decision-making skills. Scalpers often use automated trading systems to execute trades quickly and effectively.

4. Position Trading

Position trading involves holding trades for an extended period, ranging from weeks to months. Traders who adopt this strategy rely on fundamental analysis to make informed decisions. This method is less concerned with short-term market movements and more focused on long-term trends.

Technical and Fundamental Analysis

Successful Forex traders often utilize both technical and fundamental analysis to inform their trading decisions. Technical analysis involves analyzing historical price data, chart patterns, and indicators to forecast future price movements. Fundamental analysis, on the other hand, focuses on economic factors, such as interest rates, GDP growth, and geopolitical events that can impact currency values.

Technical Analysis Tools

Common technical analysis tools include:

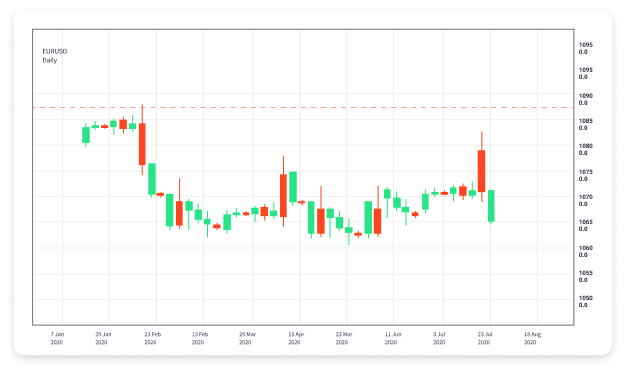

- Charts (line, bar, candlestick)

- Technical indicators (Moving Averages, RSI, MACD)

- Support and resistance levels

- Chart patterns (head and shoulders, triangles, flags)

Fundamental Analysis Factors

Key factors to consider in fundamental analysis include:

- Economic indicators (unemployment rates, inflation, consumer confidence)

- Central bank policies (interest rate decisions, monetary policy statements)

- Geopolitical developments (elections, trade agreements, conflicts)

Risk Management in Forex Trading

Risk management is a critical aspect of successful Forex trading. Without proper risk management, even the best strategies can lead to significant losses. Here are some risk management techniques traders can employ:

1. Setting Stop-Loss and Take-Profit Orders

Stop-loss orders are essential for limiting potential losses. Traders set a predetermined price level at which their position will automatically close to prevent further losses. Take-profit orders, on the other hand, enable traders to lock in profits once the price reaches a specified level.

2. Position Sizing

Determining the appropriate position size is crucial in managing risk. Traders should only risk a small percentage of their trading capital on any single trade, typically 1-2%. This approach helps mitigate the impact of losing trades on overall capital.

3. Diversification

Spreading investments across different currency pairs or trading strategies can help reduce risk and enhance the potential for returns. Diversification can protect traders from significant losses resulting from adverse movements in a single currency pair.

Choosing the Right Forex Broker

Selecting a trustworthy Forex broker is essential for a successful trading experience. Factors to consider when choosing a broker include:

1. Regulation and Reputation

Ensure that the broker is regulated by a reputable financial authority. This adds a layer of security for your funds and ensures that the broker adheres to industry standards.

2. Trading Platform

The trading platform should be user-friendly, feature-rich, and reliable. Check for compatibility with various devices and ensure that the platform provides the necessary tools for analysis and trade execution.

3. Fees and Spreads

Consider the fees associated with trading and the spreads offered by the broker. Lower fees can enhance profitability, but be wary of brokers with very low costs, as they may compromise on other essential services.

4. Customer Support

A responsive customer support team can make a significant difference, especially in a fast-paced trading environment. Check for multiple support channels, including chat, email, and phone support.

Conclusion: The Path to Successful Forex Trading

Forex trading offers unparalleled opportunities for profit, but it is not without risks. By understanding the market dynamics, employing sound trading strategies, conducting thorough analysis, and implementing effective risk management techniques, traders can navigate the complexities of the Forex market. Continuous learning and practice are vital in this journey, as the Forex landscape is ever-changing. Remember, patience and discipline are key traits of successful traders, and leveraging the right tools, including a reliable Trading Broker ID, can enhance your trading success.